Paypal are actively promoting their new payment method called paypal express. They have been very eager to get this implemented on as many sites as they can. So what does it do and what does it mean for ecommerce site owners.

Traditional ecommerce checkouts are a 5 step process.

- name / register

- billing addresss

- shipping address

- chose your payment method

- confirmation

Paypal have seen an opportunity in step 4. Like all competitors they want to eliminate the other payment providers and make it “easier” for the shopper.

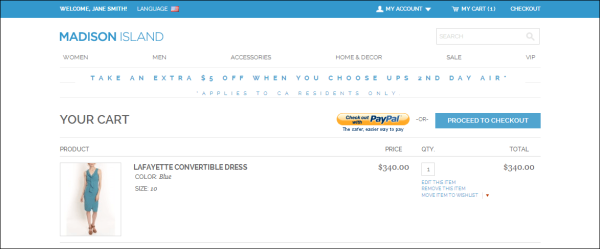

Paypal Express is presented in the first step of the payment process where the customer logs into their paypal account.

Paypal Express is presented in the first step of the payment process where the customer logs into their paypal account.

This eliminates step 2, 3, 4 for the shopper. This is a massive shift in checkout flow. It makes it easier for the shopper. As many as 20 less fields to be filled. We know that an easier shopping basket experience gives a better conversion rate.

So what can be bad about this for the shopper ? Nothing really, except that paypal collect alot more information on your shopping habits as they collect the full detail of what you are purchasing on a website.

Paypal are basically getting a copy the full order details. Remember paypal and ebay were related. With all this sales information from many small stores this can turn into very valuable information on a global scale. You no longer have to be selling on a market place to leak business intelligence.

So as a store owner what effect will this have on your business ?

- Your paypal customers have no choice of who they want to process their payments.

- Your other payment methods that charge alot less commissions are being side stepped using paypal express.

- Your business intelligence is leaving your organisation to a payment provider who has no direct need for this information

- This has the effect of making it more expensive for the store owner too.

For Paypal this is a master stroke and I have to admire the way they have implemented this. To change the traditional ecommerce checkout flow that has been there since 1996 and use it to your advantage is a master stroke. What makes it more incredible is the simplicity of it and the fact that an ecommerce store really has no option but to go for it.

For the store owner it is another erosion of margin and more worrying a leak of valuable customer and sales data outside of your organisation.

When implementing a new feature or service on your ecommerce store there are 5 questions you need to address.

- What is the monetary gain as a result of this feature ?

- What data is going to leave my organisation and am I happy with this ?

- What is effect on profit margin ?

- Is it legal and would the customer see this as underhand if they knew about it ?

- Do customers really want or find this new feature usefull ?

What will this mean for checkouts ?

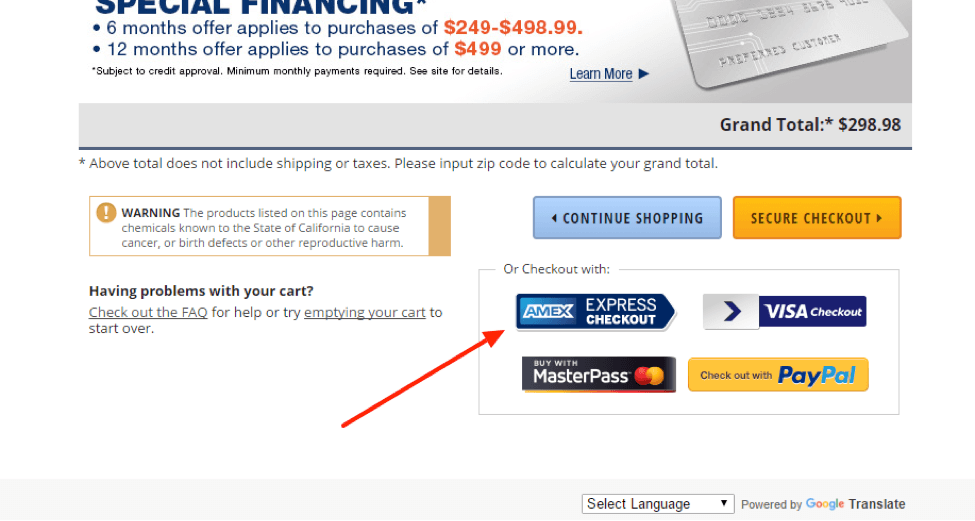

We can see plans from other payment providers to get into the same space that paypal are in now on the checkout page. They cannot and will not have the monopoly on this space. Mastercard, Visa and Amercian express have similar products. Smaller processors are going to have to invest heavily to get their product into the same space. We might be about to see a full scale online payment providers battle in this space. Eventually it will come down to commission rates having to be reduced but alot more shifts and changes need to take place for this.

We can see plans from other payment providers to get into the same space that paypal are in now on the checkout page. They cannot and will not have the monopoly on this space. Mastercard, Visa and Amercian express have similar products. Smaller processors are going to have to invest heavily to get their product into the same space. We might be about to see a full scale online payment providers battle in this space. Eventually it will come down to commission rates having to be reduced but alot more shifts and changes need to take place for this.

Is there a use case where paypal express it is not suitable?

If your site is gift focused where most of your shipments do not go to the billing address. We have seen implementations where on gift sites the customers checkout so fast that they miss the shipping options and are confirmed. Sometimes they dont even notice because it has been so quick. This causes sever customer complaints where time sensitive deliveries arrive at the billing address and the shopper has to arrange a new delivery at extra cost. It is not suitable for gifting sites such as florists. This is not because the paypal express gets it wrong, but because the shopper can easily skip the shipping address section.

As a store owner you possibly have no choice unless you are in a territory where paypal is not that strong. But be aware other vendors will see this space and move into it.

This article is not meant to recommend or condemn paypal express, but rather is an observation as a result of our multiple implementations of paypal express across many sites since 2018 when it was first released.